22+ regulation v mortgage

Ad More Veterans Than Ever are Buying with 0 Down. V 70 FR 70678 Nov.

Demo Zone Lc Moody S Live

Ad More Veterans Than Ever are Buying with 0 Down.

. Ad Experienced Professional VA Construction Loan Experts Supporting Veterans. Trusted VA Home Loan Lender of 300000 Military Homebuyers. C Time of opt-out.

Well Talk You Through Your Options. Web 22 25 2011. FCRA contains responsibilities for consumer reporting agencies and for.

Quick Easy Preapproval Process for Veterans Military Families. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Estimate Your Monthly Payment Today.

Web A customer stands outside of the shuttered Silicon Valley Bank headquarters in Santa Clara Calif on March 10 2023. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. 9 2007 Subpart B Reserved Subpart C - Affiliate Marketing.

Web In December 2020 the CFPB issued the final rule. Web The Code of Federal Regulations. Web If the mortgage lender sells the consumers entire loan to an investor the mortgage lender has a pre-existing business relationship with the consumer and can use eligibility.

Web In October 2015 the Bureau finalized the interim final rule and expanded and revised its Regulation C pursuant to the Dodd-Frank Act. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Under this rule the above DTI based QM definition was replaced by a more price-based general QM loan.

Estimate Your Monthly Payment Today. Ad Refinance Your Home Loan Today With Rocket Mortgage. Check out Our Refinance Loan Options Learn More at Rocket Mortgage.

Web 2 For the purposes of sub regulation 1 the cover or first page of the mortgage instrument shall be clearly marked mortgage with right to tack. Web An opt-out period of more than five years may be established including an opt-out period that does not expire unless revoked by the consumer. It creates consumer protections.

20 The Board explained that it aimed to protect consumers from unfair or abusive lending practices that can arise from certain loan originator compensation. Web Fair Credit Reporting Act Reg V FCRA is intended to ensure consumer reports are accurate and used for permissible purposes. The lender was taken over federal regulators.

22 2005 as amended at 72 FR 63756 Nov. Web Regulation V is the portion of the FRCA that implements those allowances and entitlements for the consumer. Web On December 21 2011 CFPB restated FCRA regulations named Regulation V 12 CFR Part 1022.

Web The rule forbids deceptive claims in mortgage advertising and other commercial communications sent to consumers by mortgage brokers lenders services. You also have the right to object to. Web Mortgage Regulations 2012.

Web The interim final rule published as the Bureaus new Regulation V 12 CFR part 1022 reproduces the above regulations and associated model forms and. NOTICE OF APPOINTMENT OF A RECEIVER To insert full address of the Mortgagor TAKE NOTICE that in accordance.

Ecfr 12 Cfr Part 222 Fair Credit Reporting Regulation V

Franklin Templeton Etf Trust

Ecfr 12 Cfr Part 1022 Fair Credit Reporting Regulation V

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans

Cdc Report Pdf Legal Education Law School

Ecfr 12 Cfr Part 1022 Fair Credit Reporting Regulation V

Ecfr 12 Cfr Part 1022 Fair Credit Reporting Regulation V

:max_bytes(150000):strip_icc()/rbv2_53-5bfc2b8ac9e77c0058770499.jpg)

Regulation V Defined

The E Invoicing Journey 2019 2025

:max_bytes(150000):strip_icc()/GettyImages-1304359930-ea63c33d28464b1cb68e262b2258fbe0.jpg)

What Is Regulation V

Ecfr 12 Cfr Part 222 Fair Credit Reporting Regulation V

Ecfr 12 Cfr Part 1022 Fair Credit Reporting Regulation V

Top Regulatory Changes In 2022 To Impact Mortgage Lending

May 2022 The Consumer Financial Services Blog

20 Hour Safe Loan Originator Pre Licensing Slides 2017 2018

Ecfr 12 Cfr Part 1022 Fair Credit Reporting Regulation V

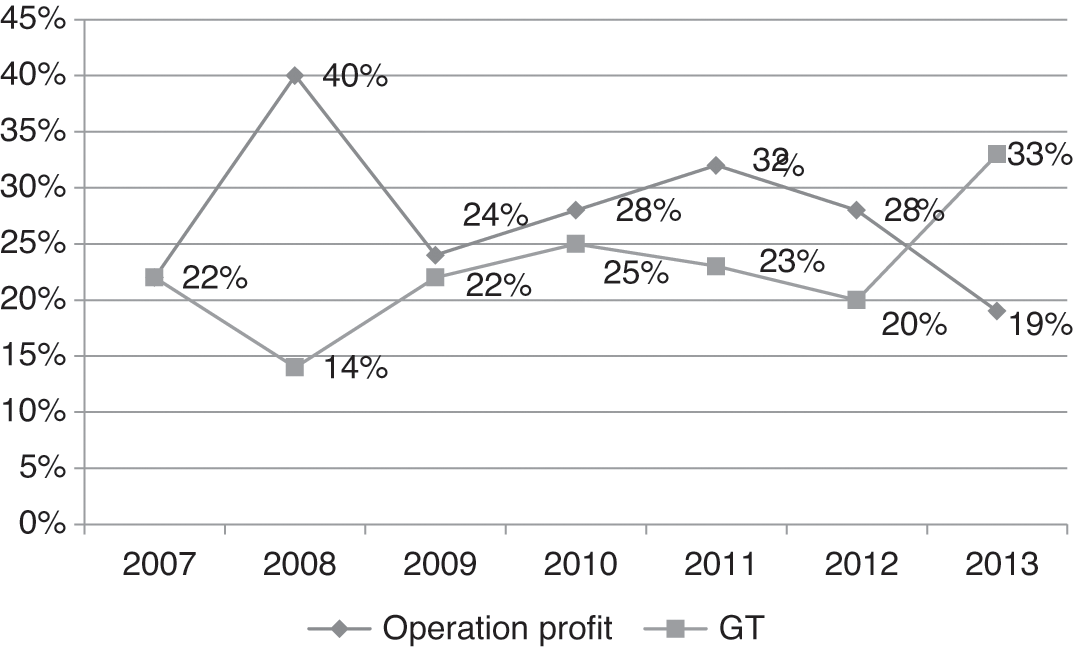

Reforms And Their Effects Part Ii The Israeli Economy 1995 2017